Revolutionizing Financial Settlements: The Journey of Temy and Rollsoft

The digital revolution of the 21st century has necessitated businesses to evolve and embrace technology, helping them to automate, optimize, and revolutionize their operations for greater efficiency, cost-effectiveness, and improved outcomes. One such trailblazing partnership that embodies this tech-enabled transformation is between Temy, a vanguard in software development, and Rollsoft, a finance innovator focused on advancing the realm of cashless settlements. This dynamic partnership has given birth to an exceptional debts reconciliation system – a cloud-based, high-load, AI-powered marvel enabling companies to hold healthier cash flows and elevate their financial performance.

Establishing a Strong Foundation: Conceptualization and Planning

The partnership was initiated with an ambitious objective – developing a long-lived, high-load web application capable of handling massive volumes of traffic while delivering optimal uptime. The collaborative journey began by drawing from the wells of Temy’s prowess in software development and Rollsoft’s visionary ideas in financial management.

Comprehensive planning marked the first step of this journey. The Temy team undertook a detailed analysis of the project requirements and objectives, which formed the basis of a well-structured project plan. The plan outlined clear goals, milestones, and deliverables. Thorough planning was instrumental in ensuring a shared understanding of the project’s scope and timeline among everyone involved.

Adopting agile project management was another strategic step taken by the team. This approach broke down the project into smaller, more manageable tasks or iterations, facilitating constant feedback, adaptation to changes, and a quick response to evolving client needs. In fact, the project was divided into two-week sprints, encouraging rapid iteration and continuous improvement based on the client’s feedback and requirements.

Effective communication was at the heart of the partnership, fostering transparency, aligning everyone involved, and allowing for timely adjustments and resolution of issues. Regular progress updates, meetings, and status reports ensured that everyone was on the same page regarding the project’s progress, achievements, and challenges.

Application – A Marvel of Technological Innovation

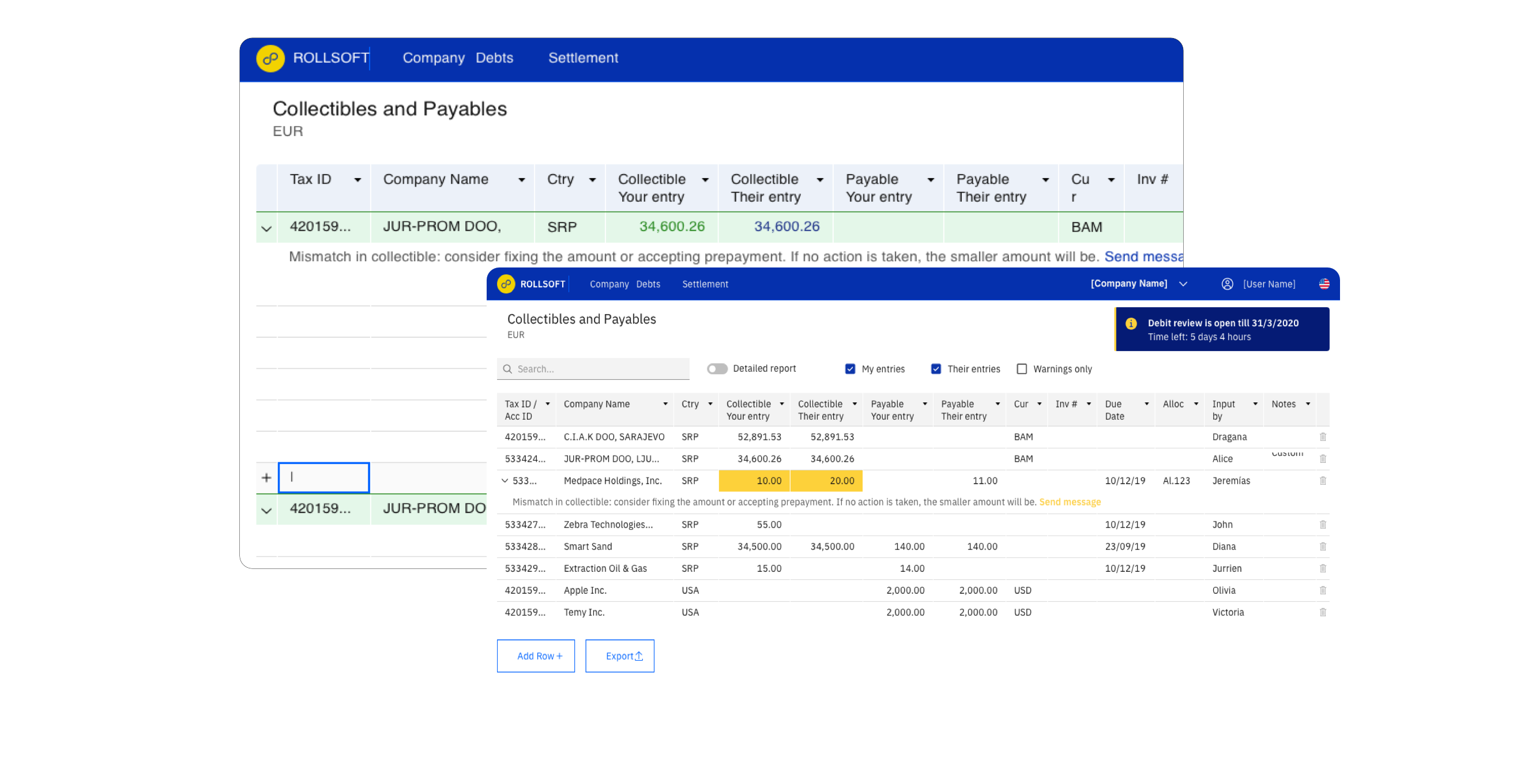

The cumulative outcome of this systematic and highly interactive approach was a user-friendly, feature-rich web application that provided an effective solution to manage payables and collectibles, thereby enhancing the financial position and liquidity of businesses. The application’s algorithm, powered by AI and machine learning, identifies potential settlements, simplifying the reconciliation process.

To ensure a seamless user experience, the application’s design and interaction closely mirrored familiar tools like Excel. This allowed users to interact with the system comfortably and efficiently, as they would with a tool they use regularly. Users could simply upload their invoices onto the system, after which the application’s smart algorithm identifies potential settlements.

This application is a testament to how thoughtful design can reduce the complexity of financial processes and deliver more efficient results. A user-centric approach was at the heart of the application’s design, aiming to reduce the number of actions required by the user while still delivering efficient results.

Confronting Challenges and Delivering Innovation

In the course of building a sophisticated and high-load application, the team was met with a few challenges. Among them were compatibility issues with third-party APIs and certain limitations of the chosen development framework. These hurdles, instead of thwarting the team’s progress, propelled them to innovate and seek solutions. Detailed research was undertaken, experts were consulted, and alternative solutions were actively sought to circumnavigate these challenges.

One of the innovative solutions developed during the process was the AI-powered recommendation engine. This feature utilizes advanced machine learning algorithms to analyze user behavior, preferences, and historical data to provide personalized product recommendations.

To handle the application’s high-load requirements, the team utilized GraphQL for the backend, allowing caching for faster performance. An AWS serverless environment was also implemented, providing high-speed, scalable performance, essential for the high-load application.